The Cyprus Real Estate Market has been established as one of the most attractive in the European Union. Cyprus, amongst others, combines high quality of life and low cost of doing business.

Recently, Cyprus’s property market has been booming1, driven in part by the desire to gain the benefit of living in an EU Country and in part by the need to move out of the United Kingdom because of Brexit but also due to the spiralling property price tags that have made it increasingly difficult for many to purchase housing within the UK.2

Moreover, Cyprus has proven in recent years as an ideal location (both taxwise and quality of life-wise) for multinational and IT companies to relocate their international and regional headquarters. This has increased the demand for office spaces as well as for various types of residential properties for key-employees and supporting staff.

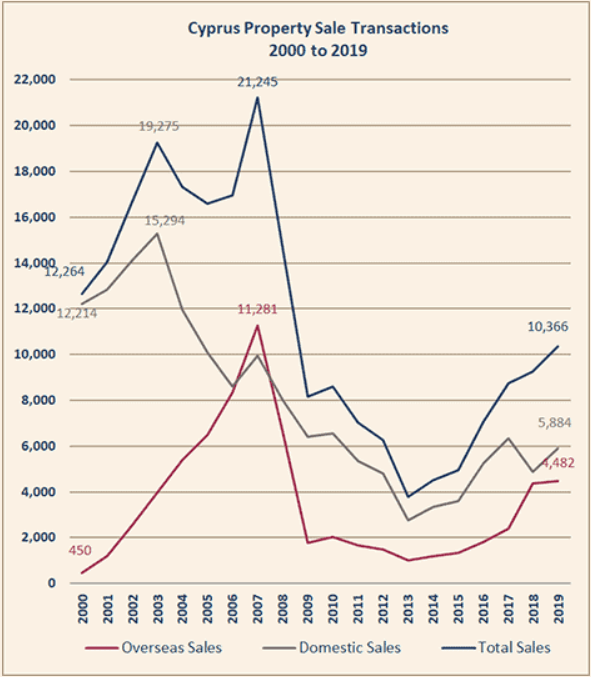

Figure 1: Cyprus Property Sale Transactions 2000 to 2019.3

From 2020 until the end of July 2023, more than 57.000 sales have been recorded, involving approximately 65.000 properties4.

Purchasing a property in Cyprus, depending on the legal status of the property in question, could be either a quite straightforward transaction or a complex one requiring delicate handling.

In most case, both parties, the purchaser, and the seller, appoint their own legal advisor to provide legal support throughout the procedure from A to Z, i.e., from the reservation of the property in favour of a purchaser until the transfer and registration of the property in the name of a purchaser.

Property searching and receiving expert advice

Buying a property could be considered as a major investment when factoring capital growth in Cyprus. Prospective purchasers should conduct thorough background investigation to comprehend precisely what they are acquiring. In Cyprus, freehold and leasehold are the two ways of holding right over immovable property.

It is advisable, before entering any kind of binding agreement, that the purchaser visits the property on site and requests to be provided, at least, with recent copies of title deed and land registry search certificates identifying any rights, encumbrances or restrictions registered against the property or the seller, including but not limited to mortgages, memos, charges, boundary disputes and rights of passage.

The most important part of taking the decision to buy the property in question is seeking independent legal advice, free of any form of outside control or influence, to protect the purchaser from signing any agreement before they understand the risks and implications of the agreement itself and the transaction.

An independent legal advisor will solely represent the purchaser’s interests and protect them from entering into an unfavourable agreement or purchasing a property with questionable legal status.

Eligibility

Foreigners wishing to purchase a property in Cyprus must have in mind that certain restrictions are in place. According to article 3 of the Immovable Property Acquisition (Aliens) Law Cap. 109, “no alien shall acquire, otherwise than mortis causa, any immovable property without the permit of the Council of Ministers first obtained”. The power has been assigned to the pertinent authority of the district where the property is situated (District Administration Office), in order to expedite and simplify the whole procedure.

The procedure requires the submission of a standard form, accompanied by supporting documents, such as documents proving good financial standing. Despite the internationally recognized broad discretion of the competent authority examining such applications, in practice, the process is quite straightforward. If the typical requirements are met, the permit is granted.

Since the procedure to obtain the required permit may take some time, it is advisable to include provisions in the contract of sale that exclude liability in case any delay from the authorities causes a delay to the whole transaction.

A legal advisor will be able to advise on whether a person is eligible to purchase a property in Cyprus, undertake the permit procedure and further advise and introduce the necessary provisions in a contract.

The permit is not required where the purchaser is a citizen of an E.U. (European Union) or E.E.A. (European Economic Area) member state, an alien of Cypriot origin or the alien wife of a Cypriot citizen.

Even where the purchaser does not fall within the abovementioned exceptions, a person interested in purchasing a property in Cyprus may surpass the restriction by choosing to incorporate a Cyprus company. Where a Cyprus company is purchasing a property, even an alien-controlled one, no permit is required.

Tax and Budget Planning

An important aspect of taking the decision to purchase a property, is considering the costs involved in buying a property in Cyprus. These costs encompass the purchase price, maintenance and moving costs, transfer fees and VAT rate, stump duty and lodge fee, legal fees, and other disbursements. Obviously, the cost of living will also be relevant for those looking to live in Cyprus. Thorough research is essential before any purchaser committing themselves as this will allow them to understand the tax regime and have a good knowledge of the market.5 These are crucial when purchasing a property in a foreign country.

- Value Added Tax. V.A.T. rate is currently at 19%. V.A.T. is applicable in purchases of new properties and in most cases in purchases of land. It is usually in addition to the purchase price. V.A.T. is not applicable where the subject matter of the sale is a resale property. A purchaser buying their first home, has the right to apply for a reduced V.A.T rate of 5%. Certain restrictions relating to the area and the price of the property apply.

- Stamp Duty. Stamp Duty is payable on documents which relate to any property/assets situated in Cyprus and/or to any matter or thing to be performed or done in Cyprus, irrespective of the place of the execution of such documents. It should be paid within 30 days from their execution. Unless otherwise agreed, stamp duty is payable by the purchaser. Stamping is possible even after the expiry of 30 days; however, certain fines apply. The calculation for the stamp duty on contracts for sale of a property is based on the value of the transaction:

| Value (Euro) | Stamp Duties |

| 0 – 5.000 | No stamp duties payable |

| 5.000 – 170.000 | €1,50 for every €1.000 |

| Amount exceeding 170.000 | €2,00 for every €1.000 with a maximum stamp duty of €20.000 |

- Fees for lodging a contract. A small fee of €50 is payable to the land registry to lodge a contract of sale. Where a sale will be achieved by way of assignment, i.e., by being assigned the rights of an existing contract of sale between the previous owner and the person who is selling, the fee is 0.5% on the purchase price of the assignment or the initial contract of sale, whichever is higher. The maximum fee payable for lodging an assignment agreement is €3.000.

- Transfer Fees. Transfer fees are payable by the purchaser for registering the acquired property under his/her name. The total amount is calculated based on the purchase price.

| Purchase price | Transfer fees |

| Up to €85 000 | 3% |

| From €85 001 to €170 000 | 5% |

| Amount exceeding €170.000 | 8% |

Where V.A.T. was paid for the purchase, no transfer fees are payable on the amount for which V.A.T. has been paid. For all other cases, a 50% reduction by law is applicable on the result of the above calculations.

In case the Land Registry believes that the purchase price agreed does not represent the actual value of the property, it can proceed with a valuation and charge transfer fees on a higher valuation. A purchaser will have to pay the transfer fees with reservation of rights, oppose the valuation of the Land Registry, appoint their valuer, and offer the valuation to the Land Registry to reconsider theirs.

From the reservation agreement to the contract of sale

An interested person, after finding a property, needs to ensure that the property will be taken off the market and reserved in their favour, until they conclude their due diligence investigation. The way to achieve this is usually through a reservation agreement where in exchange of an amount paid to the estate agent or the owner, the property is taken off the market for an agreed period of time.

In addition to the aforementioned, the reservation agreement usually contains provisions dealing with the treatment of the reservation fee in case the transaction does not proceed as well as the main commercial terms of the transaction to be included in the contract of sale, such as the purchase price, payment structure and deadline for the transfer and registration of the property in the purchaser’s name.

Once the reservation agreement is signed, the purchaser’s legal and technical team will initiate a proper due diligence investigation and money laundering checks to identify any areas of risk. After completion of the due diligence procedure the purchaser’s legal advisor will advise on any issues that may arise and proceed to negotiate the terms of the contract of sale.

It is extremely important that all the terms and conditions negotiated between the purchaser and the seller are expressly incorporated and clearly set out in the contract of sale to have binding effect.6 If the terms are unambiguous there can be limited room for disputing which conditions clearly make up the agreement or the meaning and effect they shall have.

Typically, an amount equivalent to 20% – 30% of the purchase price is to be paid by the purchaser when signing the contract of sale.

Stamp and lodge the contract of sale

Immediately after the execution of a contract of sale, the purchaser’s legal advisor must arrange for the contract to be duly stamped at the Tax Department as per the Stamp Duty Law. This is a requirement for being able to lodge the contract with the land registry for specific performance purposes and enjoy the protection of the Sale of Immovable Property (Specific Performance) Law.

Not lodging a contract with the land registry does not affect its validity in any way. That said, by lodging the contract with the land registry, an encumbrance will be created over the property in favour of the purchaser. The creation of the encumbrance prohibits the seller from selling/transferring the property to a third party, increases the protection afforded to the purchaser as well as the available remedies in case the seller fails to complete the transaction.

Completion

The final step in completing a purchase is the meeting at the land registry where the actual transfer of the property to the purchaser will take place. The purchaser settles the full amount of the purchase price and receives the title deed in their name.

Prior to this, the seller needs to obtain certain clearances, including but not limited to the Tax Clearance Certificate and confirmations from municipal, communal, and other authorities that no amount relating to the subject matter of the transaction is outstanding.

Power of Attorney

A frequently asked question is whether a person needs to be in Cyprus to initiate or complete the purchase procedure. The answer is no. While it is advisable to at least visit the property once, at no stage of the procedure physical presence is mandatory. The purchaser may grant a power of attorney to their legal advisor, authorising the legal advisor to act on their behalf and execute all acts and deeds relating to the purchase, from negotiating the reservation agreement to accepting the transfer of the property in the purchaser’s name.

Insurance

Ιt is suggested that the new owner obtains an independent insurance agency to advice on the right insurance cover for their specific circumstances. Preceding any finalisation of insurance policies it is advisable to discuss the terms with an independent legal advisor.

Bank account in Cyprus

While not obligatory, having the funds in Cyprus will facilitate the procedure and solve the issues relating to the timing of payment of the purchase price and transfer of the property.

One option is to transfer the funds to the clients account of the lawyer handling the transaction on the purchaser’s behalf. Alternatively, the purchaser is encouraged to open a bank account with a bank in Cyprus. The latter seems more appropriate, considering that the purchaser will eventually become a property owner in Cyprus and the bank account will be proven useful.

In both cases, the bank involved will perform anti-money laundering checks.

Inheritance

Once the purchaser is the registered legal owner of the property it is suggested to include the property in their succession plan, if one is in place, or seek legal counsel to prepare one.

In the absence of a valid and enforceable succession plan (for example a will or trust), the estate will be distributed in accordance with the Cyprus Wills and Succession Law (Cap. 195). Under Cyprus succession law, forced heirship rules apply. In other words, a person is not entitled to freely distribute their assets. A portion of the estate must be awarded to the heirs.

Forced heirship rules may be avoided by utilising trusts or EU Succession Regulation (Brussels IV).

Relative benefits of purchasing property in Cyprus.

Legally, Cyprus offers a significantly simpler and more lenient property purchase system than other developed countries across the world. Furthermore, and outside the legal scope of property purchasing, Cyprus combines a wide range of benefits that potential purchasers could enjoy such as preferential tax rates, low crime rates and relatively inexpensive property price tags that in recent years have shown a potential to generate a favourable long-term yield.

Note: The materials and information in this article have been prepared and are intended for informational purposes only. Legal advice should be sought for the specific matter in question.

For a list of sources, please click here.

For further information, please contact:

Panagiotis Hadjimichael, Associate

Papadopoulos, Lycourgos & Co LLC, Nicosia

e: moc.walcylpap@leahcimijdah.p

t: +357 22 676 126

#WLNadvocate #Cyprus #law #legal #lawfirm #lawyer #worldwide #business #government #EU #realestate #realestatelaw #propertylaw #stampduty #buyingproperty